Ultratech Cement is on buying spree with recent announcement of the merger of Century textile’s cement business and now with Binani Cement.

UltraTech Cement has given the highest bid of Rs.7960 under the insolvency and bankruptcy code (IBC) process initiated against Binani Cement. As a result, the committee of creditors (CoC) for Binani Cement Ltd. has accepted the UltraTech Cement’s offer. Other lenders in the CoC include IDBI Bank, Bank of Baroda, Bank of India and State Bank of India.

Binani Cement owes Rs 6,469 crore to its financial creditors and is among the top 12 companies referred by the Reserve Bank of India for insolvency proceedings. As per IBC process, the resolution plan will be sent to the National Company Law Tribunal (NCLT) for its approval.

Further, UltraTech Cement’s bid represents more than 90 percent of the outstanding debt of all financial creditors. As per the current rules, a proposal needs approval from at least 75 percent of lenders by value, to go through.

Meanwhile, the bid was approximately Rs 1,000 crore higher than the amount offered by Rajputana Properties Ltd, the second highest bidder being considered by creditors. Rajputana Properties is a wholly owned subsidiary of the Dalmia Bharat Group.

Additionally, Ultratech has also signed an agreement with Binani Industries Ltd. to buy its cement assets for Rs 7,266 crore, which is subject to lenders agreeing to withdraw from the NCLT.

Century Textiles Before Binani Cements

Ultratech has recently announced the merger of Century textile’s cement business, which has a capacity of 13.4mn t for the consideration of Rs. 86.2bn. This merger is expected to further strengthen the company’s presence in Maharashtra, Central and Eastern region.

As per the deal, the shareholders of Century would get one equity share of UltraTech, which have a face Rs 10/- each for every eight equity shares of Century of face value Rs 10 each. On the other hand, UltraTech will issue 1.4 crore new equity shares to the shareholders of Century. This will enhance its equity capital to Rs 288.58 crore, divided into 28.86 crore equity shares of Rs. 10/- each.

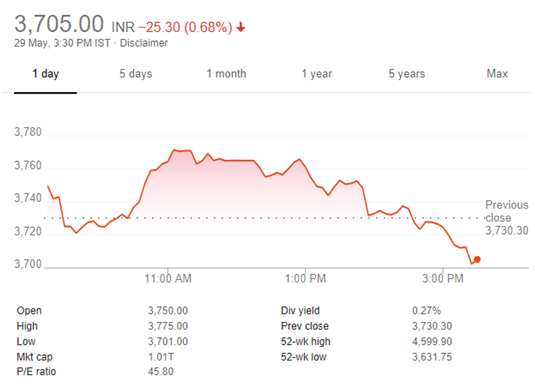

Ultratech Cement Price Chart

Ultratech Share Price Target Updated

UltraTech Cement believes that they will more than double the margins in 2-3 years. The company currently has a margin of Rs.400/t and expects to increase their margins to Rs.900/t. However, the company has weak pricing power and their valuations are stretched. Ultratech has also made two expensive deals.

UltraTech announces FY18 financial results: Volumes increase by 21% and EBITDA by 15%. Volumes grew by 31% during Q4 FY18. #UltraTechCement pic.twitter.com/EymPwNv4gl

— UltraTech Cement Ltd (@UltraTechCement) April 25, 2018

Therefore the investors should buy on dips and accumulate the stock. The target price for the stock is Rs.4500 in more than one year’s timeframe.