USD to INR: Indian Rupee To Gain Vs Rising US Dollar

USD to INR exchange rate was under a pressure during the past few sessions, and it looks like the Indian Rupee is setting up for more gains in the short term.

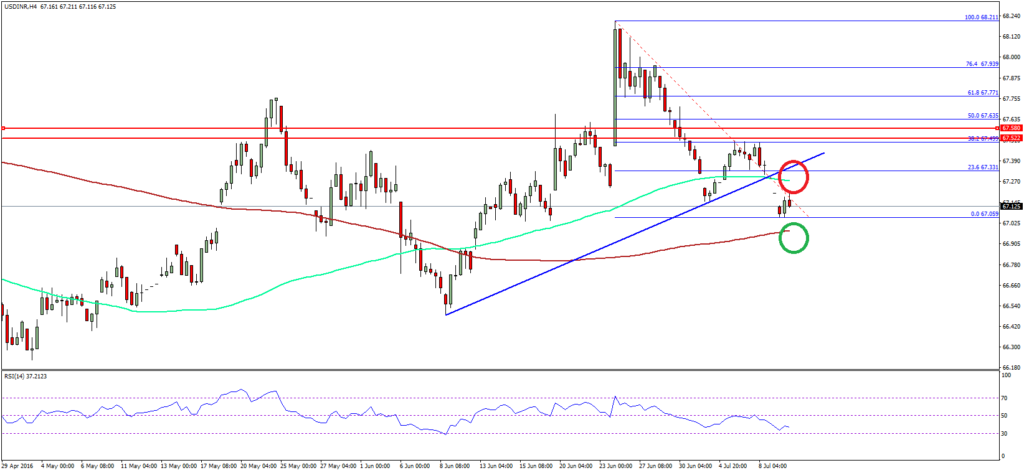

Looking the 4-hours chart of the USD/INR pair, there is a constructive pattern forming, which is a sign of a minor downside going forward.

USD/INR & US Nonfarm Payrolls Impact

This past week, there was a monster release in the US, as the nonfarm payrolls report was published by the US Department of Labor. The forecast was not lined up for the number of new jobs created during the previous month, in all non-agricultural business to rise by more than 200K in June 2016.

However, the result was above the forecast, as the US NFP came in at 287K. However, the US unemployment rate increased from 4.7% to 4.9%, which caught the market attention.

The report published, stated:

The unemployment rate increased by 0.2 percentage point to 4.9 percent in June, and the number of unemployed persons increased by 347,000 to 7.8 million. These increases largely offset declines in May and brought both measures back in line with levels that had prevailed from August 2015 to April.

The US Dollar rose against most counterparts, but what’s surprising was the Indian Rupee resiliency. It opened higher today against the US Dollar.

The impact was more due to Japan’s election, and it looks like the market missed the math behind it just like Brexit and Rexit.

Indian Rupee Forecast Versus US Dollar

The Indian Rupee gained bids against the US Dollar, as the USD/INR pair traded lower towards $67.05. it broke a major support trend line formed on the 4-hours chart, which can be seen as an early sign of more declines in USD/INR.

However, the bears must not get aggressive as the 200 SMA is sitting on the downside to act as a support.

USD To INR Support Levels

$67.00 and $66.80

USD To INR Resistance Levels

$67.25 and $67.50

Pingback: Raghuram Rajan’s Mystifying RBI Monetary Policy

Pingback: USD to INR: Can Indian Rupee Hold Gains Versus US Dollar? - Finance Minutes