Vitalik Buterin, the founder of Ethereum replied a report by Techcrunch that claims that the collapse of ETH is inevitable. He replied to a thread on reddit, and submitted his detailed view on the subject.

Recently, Techcrunch published an article with the Title – ‘The collapse of ETH is inevitable’. It was contributed by Jeremy Rubin, who is currently a technical advisor to Stellar. As per the article and author’s prediction, Ether’s value will go to zero (not the Ethereum Network itself).

The article mentioned that:

If all the applications and their transactions can run without ETH, there’s no reason for ETH to be valuable unless the miners enforce some sort of racket to require users to pay in ETH. But if miners are uncoordinated, mutually disinterested, and rational, they would prefer to be paid in assets of their own choosing rather than in something like ETH.

There were are few key points taken into the consideration to predict the value of ETH to zero. Some of them were – failure to scale, to adopt more secure contract authoring practices, or to out-compete its competitors. A few key subheads were – building unstoppable applications, No Future for ‘Gas’, and battling the economic abstraction.

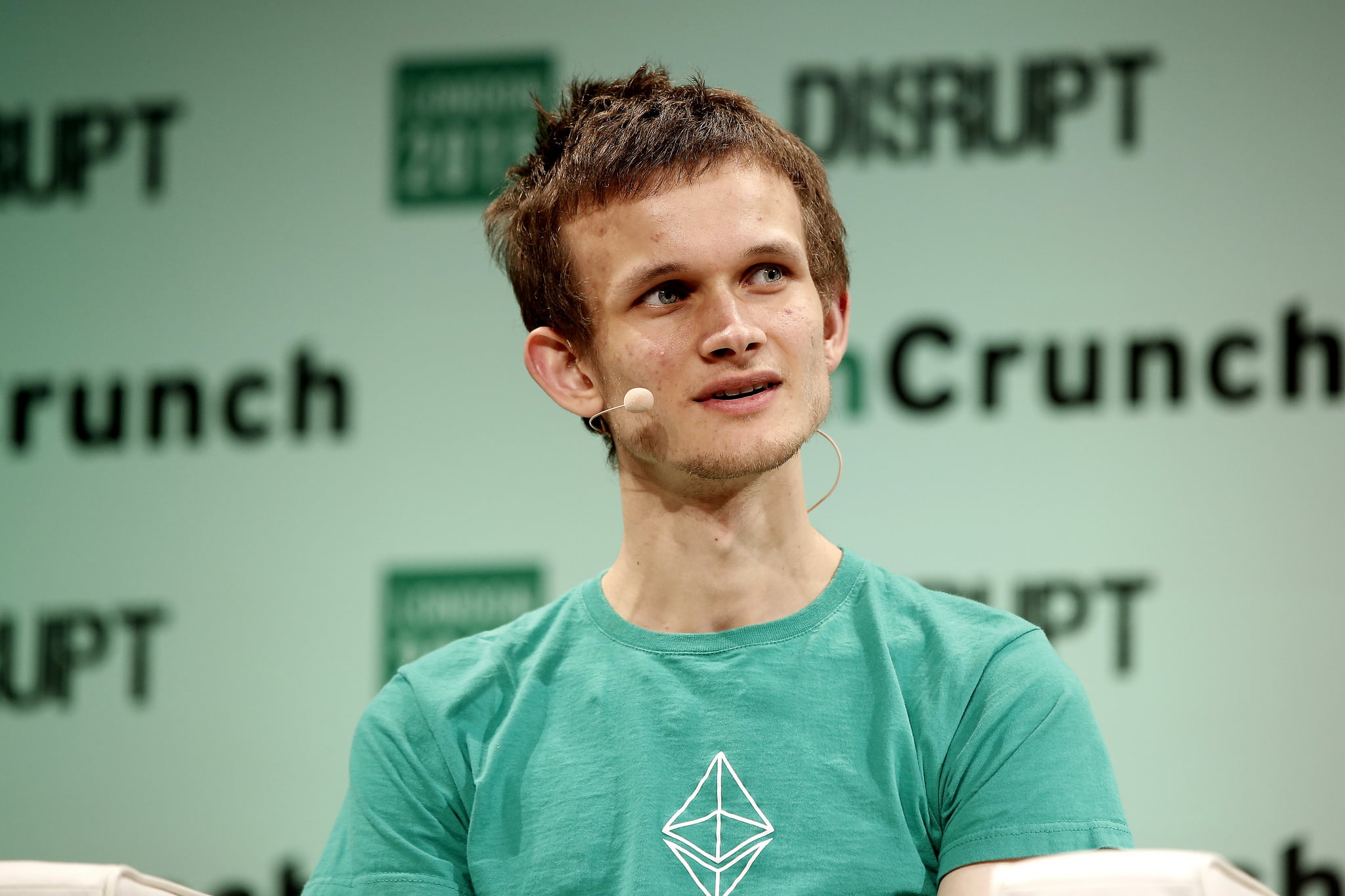

Vitalik Buterin reply to the Tall Claim of ETH going to Zero

Vitalik Buterin was obviously not impressed by the views of the author and he wrote a detailed reply on one of the reddit’s thread. He said that:

I obviously have every incentive to disagree with this, but I think there are quite a few very critical economic and technical details that the article is missing.

Regarding, “economic abstraction”, he said that “we are likely not doing full economic abstraction”. On the subject of the transaction fee, he added that, if the community is not doing HD-POS, then depositing ETH becomes the only way to get access to transaction fee revenues.

A user on reddit, joskye, also made a good point. He said:

The author is stating that there are contracts that could run on ETH network without gas consumption which would be factually incorrect; regardless of L2 scaling solutions, sidechains, complex contracts etc, at some root point these contracts would all ultimately be secured by gas consumption giving ETH inherent value.

Clearly, some were not impressed by the article and author’s view. In the long run, only time will tell whether ETH will go to zero or follow bitcoin’s path of reaching new highs.

Recently, I tweeted a user on twitter after he asked me about ETH’s future. I do not think ETH is going to die due to a strong fundamental base.

Not sure why you are scared mate? Does this mean you bought $ETH at higher levels? #Ethereum jumped from $5 to $100 -> $1,000 -> $1,400. It has all rights to CORRECT substantially since its crypto market after all.

Reg ur 2nd ques – NO ETH is not dead and it can never be 🙂— Aayush Jindal (@AayushJs) August 31, 2018

Technically, Ether’s price is currently trading above the $250 support. Once buyers succeed in a daily close above the $300 mark, there could be more gains in the near term.

Pingback: Ethereum 2.0 - The Better Ethereum and ETH's Future