July 31st is around the corner and I thought of writing something topical. It is the last date for filing Indian Income Tax returns.

Disclaimer: This case study is a bit heavy on data & tables. I have tried my best to make it easy for reader to comprehend but still would advise multiple reading to understand the essence & perspectives

To set context with some academic information from Income Tax Act:

Who should pay Income Tax?

Any ‘Person’ is liable for Income Tax & who is a Person is defined in IT act. The term “person” includes:

- an individual,

- a Hindu undivided family,

- a company,

- a firm,

- an association of persons or a body of individuals, whether incorporated or not,

- a local authority, and

- every artificial juridical person, not falling within any of the preceding sub-clauses

When should a ‘Person’ file Income Tax return

- Your gross total income (before allowing any deductions under section 80C to 80U) exceeds Rs.2,50,000 in the FY 2016-17. This limit is Rs 3,00,000 for senior citizens (who are more than 60 years old but less than 80 years old) or Rs 5,00,000 for super senior citizens (who are more than 80 years old)

- You are a company or a firm irrespective of whether you have income or loss during the financial year.

- You want to claim an income tax refund.

- You want to carry forward a loss under a head of income.

- You have exempt long term capital gains from – sale of equity shares in a company OR sale of unit of equity oriented mutual funds, OR sale of unit of business trust, of more than Rs 2,50,000 in a financial year. Even though these gains are exempt from tax, such persons have to mandatorily file an income tax return. [effective FY 2016-17, AY 2017-18]

- Return filing is mandatory if you are a Resident individual and have an asset or financial interest in an entity located outside of India. (Not applicable to NRIs or RNORs)

- Or if you are a Resident and a signing authority in a foreign account. (Not applicable to NRIs or RNORs)

- You are required to file an income tax return when you are in receipt of income derived from property held under a trust for charitable or religious purposes or a political party or a research association, news agency, educational or medical institution, trade union, a not for profit university or educational institution, a hospital, infrastructure debt fund, any authority, body or trust.

- If you are a foreign company taking treaty benefit on a transaction in India

Only 1.5% Indians Pay Tax – What does this mean?

In early 2016 Indian government released data & statistics on Income Tax after almost a gap of 15 years.– Refer IT website for data

The latest data on detailed Income tax returns is for FY 2013-2014 (AY 2014-2015). They also released time series data on IT collections for FY 00-01 to 14-15 (FY15-16 data is also presented on unaudited basis)

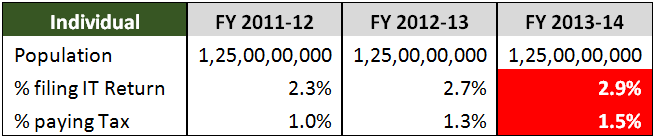

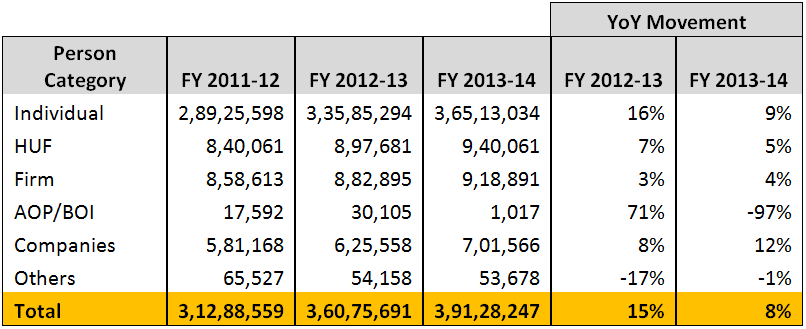

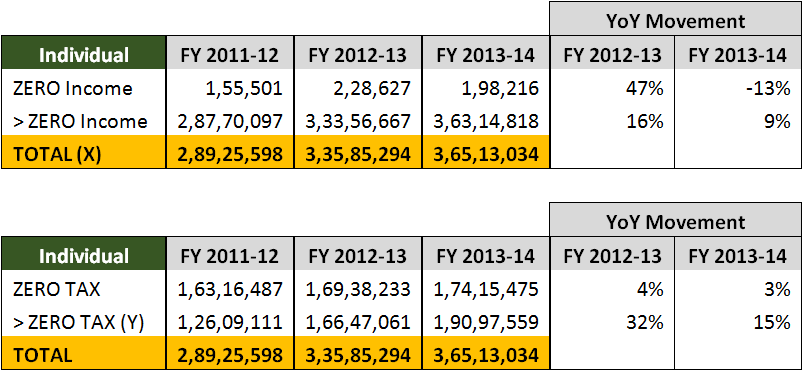

Table 1: Stats on ‘Person’ filing IT returns

YoY – Year on Year

Table 2: Stats on ‘Individual’ filing IT returns

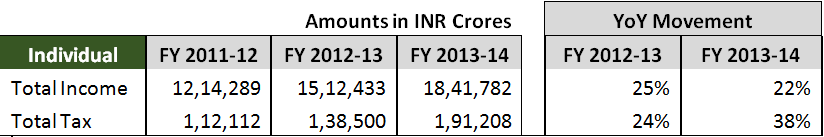

Table 3: Stats on Individual category total Income & total Tax

Assuming an average population of 125 Crores (1.25bn), the % of Indians filing tax return & paying tax is as below

Table 4: (Based on Values X & Y in Table 2)

This is how the headline was arrived – 1.5% Indians Pay tax & only 3% assessed for tax

Is this good or bad ?

Though there is wide spread criticism of only 1.5% paying tax / 3% filing return, I want to put this in perspective

- We should not assume that whole of India is earning and earning enough to pay tax. By & large those who are 15 & older are in the earning bracket. Even India’s government analysis & statistics are based on this assumption (let us keep the child labour angle out of this). In India ~ 73% are in 15 & Older category.

- Not everyone who are 15 & older have earning capacity. There is a concept called Labour Force Participation Rate (LFPR) which denotes % of population that is willing to work (either working or looking for work). In India LFPR is estimated to be 50 – 53 % in the years 2011-2014 (i.e.) 50-53% of 15 or older population is willing to work. In 2016 it is at 50.3%

The next factor that is important to consider is unemployment. In India unemployment rate is estimated to be 5-6% in the years 2011-2014. In 2016 it is around 5%. Data

- Not everyone needs to pay tax:

- Depending on the FY, there is no tax on income upto INR 2lakhs p.a or 2.5lakhs p.a

- IT act has given a broad definition for ‘Agricultural Income’ and Agricultural income is exempt from tax. Almost 46% of India’s workforce is estimated to be employed in Agriculture

- There are host of other tax saving & tax exempt provisions in the act

- High level estimate is that only 20% of Indians have annual income of INR 1.7 lakhs & 13 % of households have annual income of INR 2.5 lakhs – Data

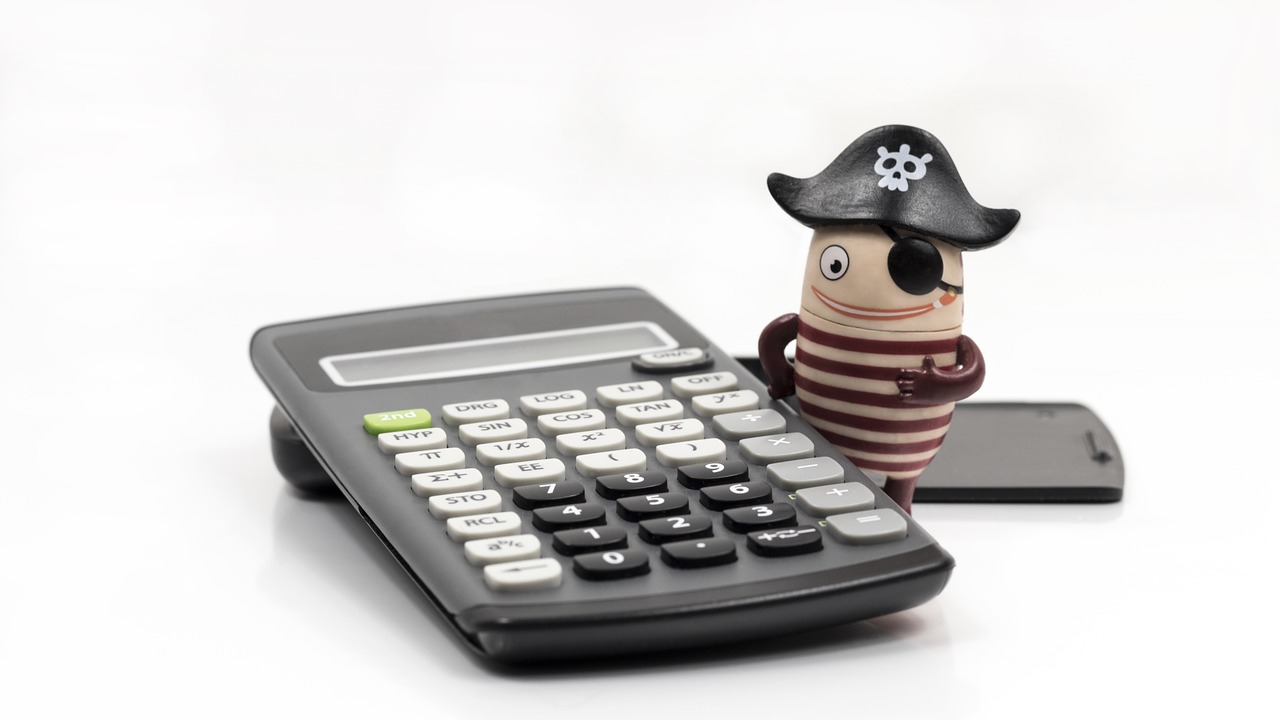

Table 5: Putting all of this together – A best effort estimate

[For those who might wonder why the actual number of returns filed is more than estimate, it could be because of a few possibilities – a) People filing return despite having agricultural income, b) Non-Indians filing tax return (Foreign citizens but Indian Tax residents would have filed return)]

So What ? – Is this bad ?

- Based on Table 5, we expect ~3 Cr Individuals to file tax return & the reality is not too far away (Tables 2 & 4) – I think this is not bad

- We see a good trend of more individuals filing tax return – So not so bad

- With increased awareness, digitalisation & simplification of IT return filing process, this statistic is going to be very healthy in favour of individuals

What is not so good in my opinion?

- Lack of transparency & delay in data – Even though it is nice to see data being published by government, it is long due, still not very quick (we are atleast 3 years behind in data) and quality of data has some distance to cover – e.g there is still no data on Agricultural income filed in IT return, comparison of IT returns to PAN etc. Only available data is a reply to an RTI petition and that too is being challenged for accuracy

- The ‘black hole’ called Agricultural income – The tax base is low. By design, expecting only ~3% to fall into tax umbrella in a population of 1.25bn is not fair. Many consider ‘Agricultural Income’ as the laundromat for tax evasion. There is lot of debate & opinions on whether Agricultural income should be taxed or not. I will cover this in the next section.

How does the future look like

Referring to the Economic Survey of 2016-2017, there is a suggested five-pronged approach towards taxation in general:

- GST with broad coverage to include activities that are sources of black money creation—land and other immovable property—should be implemented;

- Individual income tax rates and real estate stamp duties could be reduced;

- The income tax net could be widened gradually and, consistent with constitutional arrangements, could progressively encompass all high incomes. (After all, black money does not make fine sectoral distinctions);

- The timetable for reducing the corporate tax rate could be accelerated; and

- Tax administration could be improved to reduce discretion and improve accountability

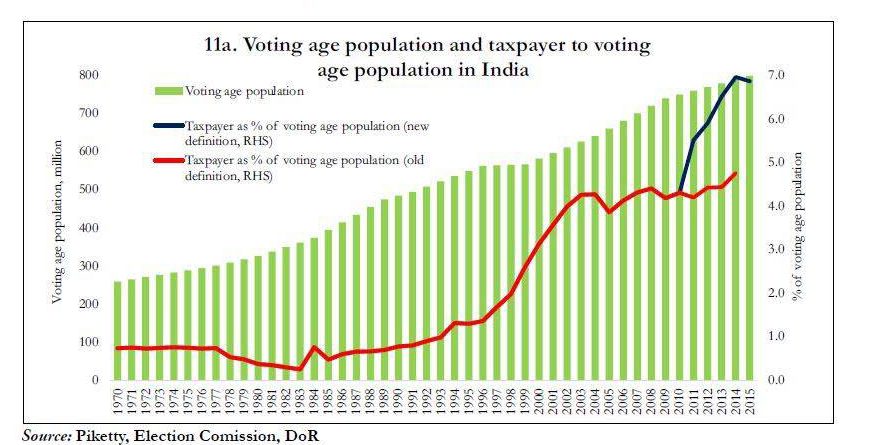

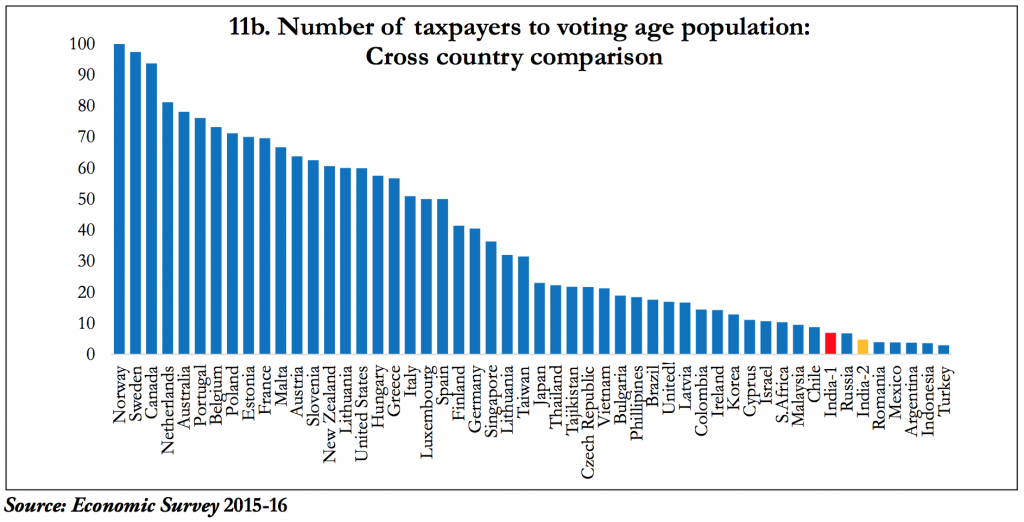

The survey opines that India’s tax base is low. Refer charts below from the survey

Old definition – Tax returns, New definition – Tax returns + TDS deposited but no tax return

My Concluding views

- The plan in the economic survey broadly indicates the intent of the government. With the push towards digitalisation of financial transactions, expanding scope of PAN & AADHAAR mandate & IT department getting equipped with more ready data, more individuals will be forced to file IT return.

- Even now filing IT return is highly recommended even if the income is below minimum taxable value because it is perceived as a good indicator of financial status & at some levels, integrity

- Loan applications & VISA applications for many countries have almost made submitting IT returns mandatory

- High value insurance cover mandates IT return

- Self-employed people without Form 16, IT returns are key evidence of their financial status

- Addressing the low tax base problem, tax framework on Agricultural income will be one of the hot topics in the next 12 months and if not, it will be in H2 2019 (if this government gets another 5 year majority mandate). There is lop sided tax burden on Non-Agricultural labour force of the country and this is a major reason that fosters non-compliance or tax evasion. Reducing this burden will go a long way in fuelling the positivity in this industry segment too

- Leveraging on grass root level changes in the system, big data & digitalisation Agricultural income might be classified into segments:

- Income earned by Organised & unorganised enterprises

- Income classified based on land holding size

- Income classified based on profitability of crops

This would facilitate focussed plans for different agriculture segments for better governance, data collection & analysis.

- There is lot of State vs. Centre ambiguity around Agricultural income tax and that should be clarified & simplified. As a starting point, tax on selective agriculture income might be introduced and states would be reimbursed going down up to the Panchayats. An empowered panchayat would improve compliance in the near term.

- Tax if any on Agricultural income could be ring fenced for spending on Agriculture development efforts – R&D, Farmer financial support – a Farmer only bank etc

- Improving LFPR (Labour force participation rate) is also a key agenda. Cultural & mindset changes, women empowerment, better environment for small time entrepreneurs will all improve LFPR (i.e.) more people will be willing to work & more women will come into workforce. This must be done in conjunction with job creation else unemployment rate will increase.

Pingback: Increased Income Tax Returns and PAN Deactivation Drive

Pingback: Income Tax Rate Cut or GST on Petrol and Diesel: Which is Better for Govt

Pingback: Don't Miss Income Tax Return Filling Last Date 31st March 2018

Pingback: Is Indian Economy Becoming More Tax Compliant with Rising Purchasing Power?