Input Tax Credit can be claimed by regular dealers under GST who possess tax invoice with them and their returns are filled. Input Tax Credit is the most confusing part while filling GSTR 3B hence a series of FAQs regarding some confusions on ITC.

What is Input Tax Credit?

ITC means Tax paid on sales minus tax paid on purchase. To avoid paying double tax, the dealer can reduce the tax paid by him from the tax levied on sales made by him when he purchased the goods or services from his supplier.

Understanding who can Claim ITC:

ITC can be claimed when:

- When you buy goods from a registered supplier and have paid taxes on the goods.

- When you have valid invoice of the goods that you have purchased.

- You make sale and you have invoice of the sales made.

- Returns have been filed and tax is paid by the supplier to the government.

Can one use Credit of CGST in SGST and Vice Versa?

No. You cannot use credit of CGST in SGST and Vice Versa but you can use it in IGST in both the cases. You may enter the numbers but while setting off liability offset, you will face problem and will be asked to fill the correct numbers.

Can one avail ITC in case of reverse charge?

Yes. You can avail ITC in case you have paid tax under reverse charge of an unregistered supplier of service or goods. For this you need to mention the details of invoice applicable for reverse charge.

Can Composition Scheme Holders Opt for ITC?

No. One cannot opt for ITC if he or she is a tax payer registered under composition scheme of GST.

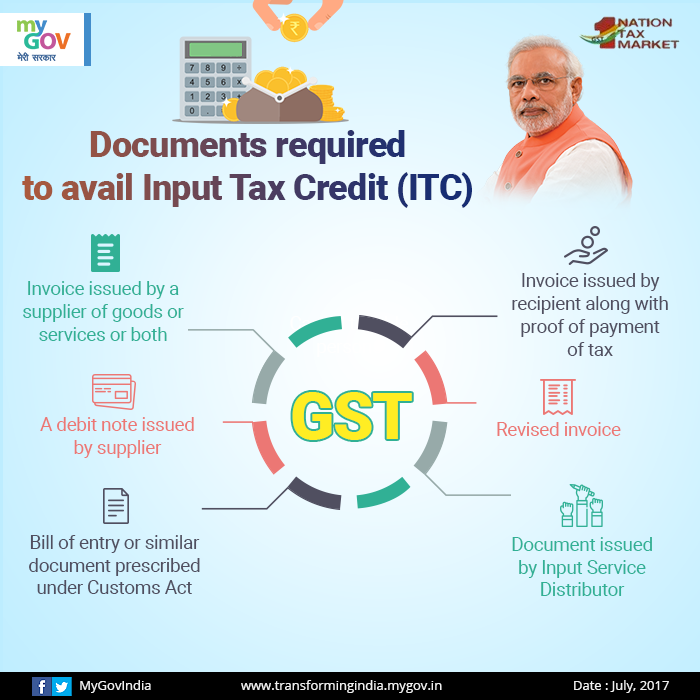

What are the Documents required to Claim for ITC?

The list of documents required are:

- Invoice that is issued by the supplier of goods or service.

- Tax paid for the invoice by the supplier.

- The debit note issued by the supplier to the recipient.

- Bill of entry

- Invoice or credit note issued by ISD

- Bill of supply issued by supplier.

When are the above documents required?

To claim ITC, you need the invoice, bill of supply and other such notes when you are filling GSTR 2. You don’t need any kind of bill wise details while filling GSTR 3B as you are only required to fill the figures.

Is ITC available on Capital Goods?

Yes. ITC is available on capital goods but with few clauses. You can’t claim ITC while manufacturing exempted goods. You also can’t claim when manufacturing/using goods for personal needs.

In case of Inter-State Supply. Can one utilize the credit of one state on another?

No. You need to use the credit of respective state on the same state.

What to do when Discrepancy is found while filling ITC return?

You will be communicated by the concerned authority in case a discrepancy is found in the invoice of the supply with respect to sale. You will be asked to rectify the discrepancy for the concerned month. If you fail to do that, the excess ITC will be added to the outward tax liability of the recipient for the next month.

These are few common questions that are asked while filling returns.

Pingback: GST Composition Scheme Widens Tax Base for Government

Pingback: GST On Export Of Services by Freelancers on Upwork, Fiverr

Pingback: GST Collections Down to Rs 80,808 Cr in December, Major Fiscal Impact?